Aurora Networks™ (ANS) and RUCKUS® Networks are now Vistance™ Networks

Visit their new site for all products and content

Aurora Networks™ (ANS) and RUCKUS® Networks are now Vistance™ Networks

Visit their new site for all products and content

Third Quarter Highlights

* RemainCo financial measures reflect the results of the RUCKUS and Access Network Solutions (ANS) segments, in the aggregate, and exclude the results and performance of the Connectivity and Cable Solutions (CCS) segment. RemainCo financial measures also exclude general corporate costs that were previously allocated to the Outdoor Wireless Networks (OWN) segment and Distributed Antenna Systems (DAS) business unit, since these costs were not directly attributable to these discontinued operations.

(1) See “Non-GAAP Financial Measures” and “Reconciliation of GAAP Measures to Non-GAAP Adjusted Measures” below.

(2) The cash flows related to discontinued operations have not been segregated. Accordingly, this cash flow information includes the results of continuing and discontinued operations.

CLAREMONT, NC, October 30, 2025 — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended September 30, 2025.

“We are pleased with our outstanding results in the third quarter. All businesses continue to deliver strong results as we take advantage of strong market conditions and deliver against our strategic initiatives. CommScope net sales of $1.63 billion increased 50.6% from the prior year. Non-GAAP adjusted EBITDA was $402 million, a strong improvement of 97% year-over-year, marking the sixth consecutive quarter of adjusted EBITDA growth. Third quarter adjusted EBITDA as a percentage of revenues was 24.7%, compared to 18.9% in the prior year, a year-over-year improvement of 580 basis points. The performance is a testament to our focus on what we can control and our team implementing that strategic focus. We are well positioned as we move into the fourth quarter and are raising our 2025 consolidated adjusted EBITDA guideposts to $1.30 to $1.35 billion as well as raising our RemainCo adjusted EBITDA guidance to $350 to $375 million,” said Chuck Treadway, President and Chief Executive Officer.

We now expect our CCS deal to close in the first quarter of 2026. When the deal closes, we plan to repay all existing debt, redeem our preferred equity and add modest new leverage to the remaining company. This will generate significant excess cash, and we expect to distribute a substantial portion of such excess cash to our common shareholders as a special dividend within 60 to 90 days following the closing of the transaction. The exact amount of the special dividend will be determined after the CCS closing, taking into account all relevant factors at the time.

“We are extremely happy with our strong cash flow generation. During the quarter, we increased our cash balance by $134 million and ended the quarter with $705 million of cash. As evidenced by the third quarter results in ANS and RUCKUS, we are excited about the future of the remaining company. On a twelve-month trailing basis, ANS and RUCKUS Non-GAAP adjusted EBITDA was $344 million, an increase of 135% versus the previous twelve-month period,” said Kyle Lorentzen, Chief Financial Officer.

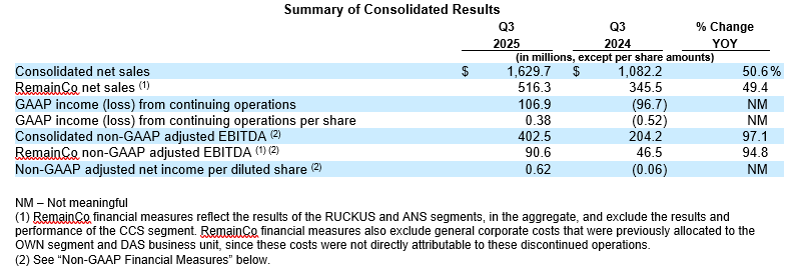

Third Quarter Results and Comparisons

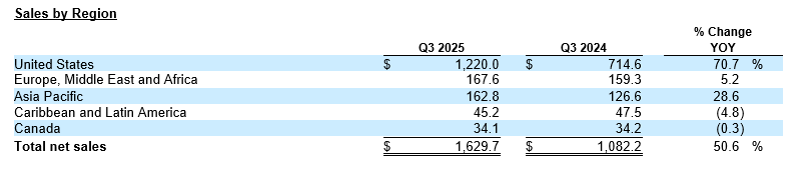

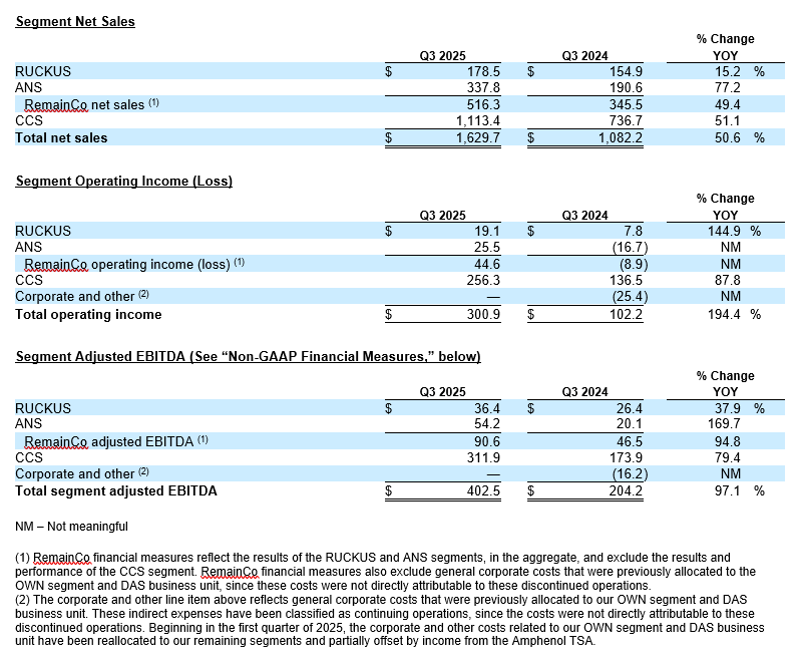

Consolidated net sales in the third quarter of 2025 increased 50.6% year-over-year to $1.63 billion due to higher net sales in all segments. Consolidated net sales increased across all regions, except the Caribbean and Latin America region.

Income from continuing operations of $106.9 million, or $0.38 per diluted share, in the third quarter of 2025, increased compared to the prior year period’s loss from continuing operations of $96.7 million, or $(0.52) per share. Non-GAAP adjusted net income for the third quarter of 2025 was $172.0 million, or $0.62 per diluted share, versus $(13.2) million, or $(0.06) per share, in the third quarter of 2024.

Consolidated non-GAAP adjusted EBITDA increased 97.1% to $402.5 million in the third quarter of 2025 compared to the same period last year. Non-GAAP adjusted EBITDA as a percentage of net sales increased to 24.7% in the third quarter of 2025 compared to 18.9% in the same prior year period. RemainCo non-GAAP adjusted EBITDA increased 94.8% to $90.6 million in the third quarter of 2025 compared to the same prior year period. RemainCo non-GAAP adjusted EBITDA as a percentage of net sales increased to 17.5% in the third quarter of 2025 compared to 13.5% in the same prior year period.

Reconciliations of the reported GAAP results to non-GAAP adjusted results are included below.

Third Quarter Comparisons

Cash Flow and Balance Sheet

Conference Call, Webcast and Investor Presentation

CommScope will host a conference call today at 8:30 a.m. ET in which management will discuss third quarter 2025 results. The conference call will also be webcast.

The live, listen-only audio of the call will be available through a link on the Events and Presentations page of CommScope’s Investor Relations website.

A webcast replay will be archived on CommScope’s website for a limited period of time following the conference call.

During the conference call, the Company may discuss and answer questions concerning business and financial developments and trends that have occurred after quarter-end, including questions relating to the planned sale of its CCS segment. The Company’s responses to questions, as well as other matters discussed during the conference call, may contain or constitute information that has not been disclosed previously.

About CommScope:

CommScope (NASDAQ: COMM) is pushing the boundaries of technology to create the world’s most advanced wired and wireless networks. Our global team of employees, innovators and technologists empower customers to anticipate what’s next and invent what’s possible. Discover more at www.commscope.com.

Follow us on LinkedIn and X. Sign up for our press releases and blog posts.

Investor Contact:

Massimo DiSabato, CommScope

Massimo.DiSabato@commscope.com

News Media Contact:

publicrelations@commscope.com

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP financial measures enhances an investor’s understanding of our financial performance. CommScope management further believes that these financial measures are useful in assessing CommScope’s operating performance from period to period by excluding certain items that we believe are not representative of our core business. CommScope management also uses certain of these financial measures for business planning purposes and in measuring CommScope’s performance relative to that of its competitors. CommScope management believes these financial measures are commonly used by investors to evaluate CommScope’s performance and that of its competitors. However, CommScope’s use of certain non-GAAP terms may vary from that of others in its industry. Non-GAAP financial measures should not be considered as alternatives to operating income (loss), net income (loss), cash flow from operations or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance, operating cash flows or liquidity. A reconciliation of each of the non-GAAP measures discussed herein to their most comparable GAAP measures is below.

RemainCo Financial Measures

RemainCo financial measures are the aggregate of the RUCKUS and Access Network Solutions segments. They do not include the results of the Connectivity and Cable Solutions (CCS) segment. RemainCo financial measures also exclude general corporate costs that were previously allocated to the Outdoor Wireless Networks (OWN) segment and Distributed Antenna Systems (DAS) business unit, since these costs were not directly attributable to these discontinued operations. The RemainCo segments and the CCS segment represent the business segments as currently managed and reported by CommScope. Future results and the composition of any business divested in the future may vary and differ materially from the presentation of the RemainCo financial measures.

Forward Looking Statements

This press release includes certain statements that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our current views with respect to future events and financial performance. These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “potential,” “anticipate,” “should,” “could,” “designed to,” “foreseeable future,” “believe,” “think,” “scheduled,” “outlook,” “target,” “guidance” and similar expressions, although not all forward-looking statements contain such terms. This list of indicative terms and phrases is not intended to be all-inclusive.

These forward-looking statements are subject to various risks and uncertainties, many of which are outside our control, including, without limitation, the occurrence of any event, change or other circumstances that could give rise to the termination of the purchase agreement with Amphenol Corporation (“Amphenol”), pursuant to which Amphenol has agreed to acquire our CCS segment (the “proposed transaction”); the inability to complete the proposed transaction due to the failure to satisfy the conditions to completion of the proposed transaction, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction; risks related to disruption of management’s attention from the Company’s ongoing business operations due to the proposed transaction; the effect of the announcement of the proposed transaction on the Company’s relationships, operating results and business generally; the risk that the proposed transaction will not be consummated in a timely manner; exceeding the expected costs of the transaction; our dependence on customers’ capital spending on data, communication and entertainment equipment, which could be negatively impacted by a regional or global economic downturn, among other factors; the potential impact of higher than normal inflation; concentration of sales among a limited number of customers and channel partners; risks associated with our sales through channel partners; changes to the regulatory environment in which we and our customers operate; changes in technology; industry competition and the ability to retain customers through product innovation, introduction, and marketing; changes in cost and availability of key raw materials, components and commodities and the potential effect on customer pricing and timing of delivery of products to customers; risks related to our ability to implement price increases on our products and services; risks associated with our dependence on a limited number of key suppliers for certain raw materials and components; risks related to the successful execution of CommScope NEXT and other cost saving initiatives; potential difficulties in realigning global manufacturing capacity and capabilities among our global manufacturing facilities or those of our contract manufacturers that may affect our ability to meet customer demands for products; possible future restructuring actions; the risk that our manufacturing operations, including our contract manufacturers on which we rely, encounter capacity, production, quality, financial or other difficulties causing difficulty in meeting customer demands; our substantial indebtedness, including our upcoming maturities and evaluation of capital structure alternatives and restrictive debt covenants; our ability to refinance existing indebtedness prior to its maturity or incur additional indebtedness at acceptable interest rates or at all; our ability to generate cash to service our indebtedness; the ability to recognize the expected benefits of the sales of the CCS business and prior transactions, including the expected financial performance of CommScope following the proposed transaction and prior sales transactions; the effect of the proposed transaction and prior sales transactions on the ability of CommScope to retain and hire key personnel and maintain relationships with its key business partners and customers, and others with whom it does business, or on its operating results and businesses generally; the response of CommScope’s competitors, creditors and other stakeholders to the proposed transaction and prior sales transactions; potential litigation relating to the proposed transaction and prior sales transactions; our ability to integrate and fully realize anticipated benefits from prior or future divestitures, acquisitions or equity investments; possible future additional impairment charges for fixed or intangible assets, including goodwill; our ability to attract and retain qualified key employees; labor unrest; product quality or performance issues, including those associated with our suppliers or contract manufacturers, and associated warranty claims; our ability to maintain effective management information technology systems and to successfully implement major systems initiatives; cyber-security incidents, including data security breaches, ransomware or computer viruses; the use of open standards; the long-term impact of climate change; significant international operations exposing us to economic risks like variability in foreign exchange rates and inflation, as well as political and other risks, including the impact of wars, regional conflicts and terrorism; our ability to comply with governmental anti-corruption laws and regulations worldwide; the impact of export and import controls and sanctions worldwide on our supply chain and ability to compete in international markets; changes in the laws and policies in the United States affecting trade, including the risk and uncertainty related to tariffs or potential trade wars and potential changes to laws and policies, that may impact our products and costs; the costs of protecting or defending intellectual property; costs and challenges of compliance with domestic and foreign social and environmental laws; the impact of litigation and similar regulatory proceedings in which we are involved or may become involved, including the costs of such litigation; the scope, duration and impact of disease outbreaks and pandemics, such as COVID-19, on our business, including employees, sites, operations, customers, supply chain logistics and the global economy; our stock price volatility; income tax rate variability and ability to recover amounts recorded as deferred tax assets; and other factors beyond our control. These and other factors are discussed in greater detail in our 2024 Annual Report on Form 10-K and may be updated from time to time in our annual reports, quarterly reports, current reports and other filings we make with the Securities and Exchange Commission. Although the information contained in this press release represents our best judgment as of the date of this release based on information currently available and reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements, which speak only as of the date made. We are not undertaking any duty or obligation to update this information to reflect developments or information obtained after the date of this press release, except to the extent required by law.

—END—