In the U.S. and around the world, wireless regulators are turning their attention to the 6 GHz band. The 6 GHz band is creating buzz because of the tensions between licensed mobile broadband services, Wi-Fi 6E advocates, and over-the-top (OTT) big tech players, all of whom are trying to grab more of the controversial 6 GHz band.

Radio spectrum is a finite and limited resource to begin with. The periodic World Radio Conference (WRC), an international platform organized by the ITU, is responsible for regulating wireless spectrum allocation and harmonization. As spectrum allocation applies to everything from air to wireless telecom services, industrial lobbying at the WRC is very common. Each party aims to capture a bigger share of spectrum to their business advantage.

CLICK TO TWEET: CommScope’s Mohamed Nadder Hamdy explains the allocation of 6 GHz spectrum for unlicensed use and what this means for the mobile industry.

Unlicensed won the prize

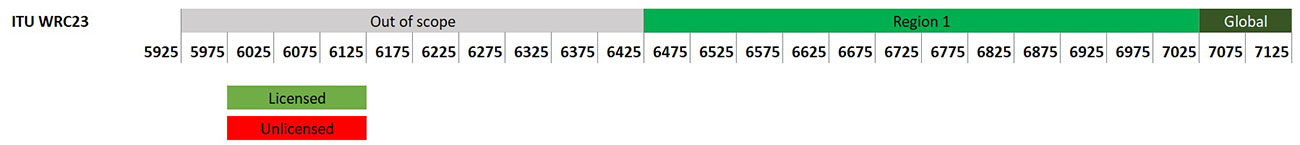

During the most recent WRC in 2019, it was agreed to enroll the 6 GHz band for a decision during the upcoming WRC, which isn’t scheduled until 2023. However, due to monumental pressures from unlicensed wireless advocates, national WRC administrations agreed to leave the lower end (5925–6425 MHz) for license-exempt use and only study the upper band (6425–7125 MHz) for licensed mobile services (See Figure 1).

Figure 1, WRC-23 Agenda Item 1.2

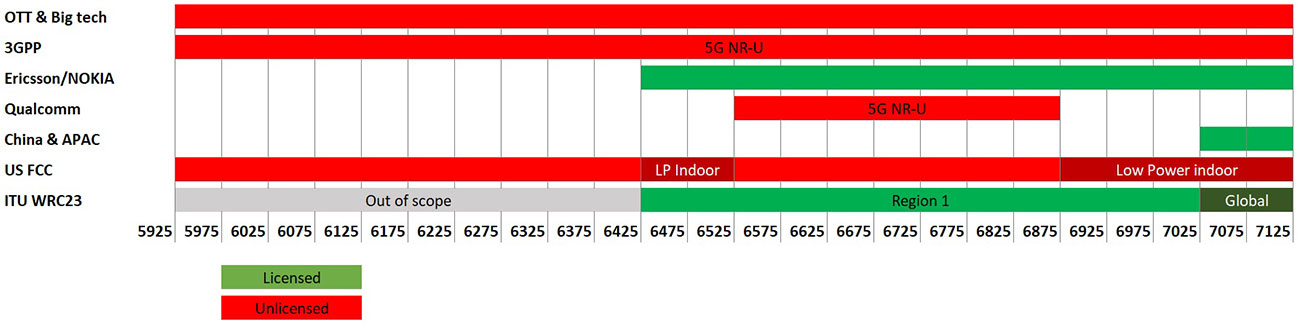

On the other hand, 3GPP, the industry consortium behind 5G technical specifications, has taken a balanced approach, studying the entire band for 5G unlicensed operation or NR-U.

Then, in a dramatic decision in April 2020, the US Federal Communications Commission (FCC) adopted rules that made the full 1,200 MHz of spectrum in the 6 GHz band (5.925–7.125 GHz) available for unlicensed use; partially for low-power indoor use and the majority under an Automated Frequency Coordination (AFC) framework for unlicensed use. This was immediately adopted by the Wi-Fi community as Wi-Fi-6E, promising unprecedented experiences for Wi-Fi users. More details on Wi-Fi-6E can be found in this CommScope white paper.

New opportunities with 6 GHz

The allocation of 6 GHz spectrum for unlicensed use is creating much excitement and momentum within the Wi-Fi ecosystem. Since the April decision was made, a number of nations, most recently Brazil and Saudi Arabia, started following the U.S. in making the band available for unlicensed use, while many others are still closely observing developments for a decision. Figure 2 summarizes the different industrial views.

Figure 2, 6 GHz positions

The unlicensed assignments are gaining ground every day, establishing themselves as the de facto technologies. For example, the Wi-Fi-6E ecosystem is taking shape and we see the standardization development of 5G NR-U against the licensed and unlicensed backdrop.

While the WRC timetable for a decision in 2023 on 6GHz band allocation for the mobile industry seems like a faraway dream for the licensed allocation advocates, one thing we can be sure of is that the 6GHz band will be a hot topic for the next few years.